Do you have trouble saving money no matter how hard you try? Do you find yourself buying unnecessary things and snatching up bargains on everything you see? Then you might have a spending problem, and it could be hurting your bank account.

It’s not a secret that people across the world struggle with managing their budgets. As of 2022, about 64% of Americans live paycheck-to-paycheck. Are you looking for a place to start?

Luckily, you’re in the right place. Below, we’ve got a guide on how to manage a budget that works. Keep reading to learn more!

Set Financial Goals

Budgeting effectively requires you to have a clear understanding of your financial goals. Once you know what you are aiming to achieve, you can work backward to create a budget that will help you get there. That budget should include both your long-term goals and your short-term goals, as well as a realistic estimation of your income and expenses.

To make sure your budget is effective, review it regularly and make adjustments as needed. And finally, don’t be afraid to seek professional help and budget management advice if you are struggling to manage your finances. There are many resources available to assist you in making a spend management strategy that works for you and your family.

Monitor Your Income and Expenses

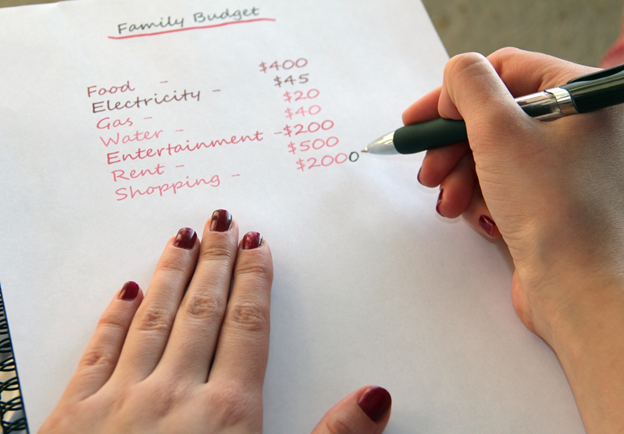

You need to know how much money is coming in and going out. This will help you make informed decisions about where to spend your money and how to save. You can create a budget by tracking your income and expenses over time.

This will help you see where your money is going and where you can make changes. You can also use a tool for a budget management guide to help you track your income and expenses. This can be a great way to stay on track and make sure you are managing your budget effectively.

Identify Needs and Wants

To manage a budget effectively, it is important to first identify what your needs and wants are. This will help you to allocate your funds in a way that is most beneficial to you.

Needs are items that are essential to your survival or well-being, such as food and shelter. Wants are items that you would like to have, but are not necessary, such as a new car or a vacation.

Once you have determined what your needs and wants are, you can begin to create a budget that meets your needs and allows you to save for your wants. This will help you to stay on track and avoid overspending.

Have Emergency Funds

It’s important to have a budget and to stick to it to save money. But what do you do when unexpected expenses pop up? That’s where having emergency funds comes in handy.

Have a realistic emergency fund. This should be enough to cover unexpected expenses like medical bills, car repairs, or job loss.

When you have a plan for your money, you’re more likely to stick to your budget. Life happens and your budget may need to change from time to time. Be flexible and adjust as needed.

Learning How to Manage a Budget Is Essential

Learning to manage a budget is essential for anyone who wants to be financially successful. It is the key to controlling spending, saving money, and achieving financial goals. There are many resources available to help you learn how to manage a budget, so take advantage of them and get started today!

To learn more informative facts, be it for business or personal finances, visit our blog page.